Back

Contents

1. General Ledger Accounts

1.1 Overview

1.2 Create New Accounts

1.3 Look Up Accounts

2. Cashbook

2.1 Overview

2.2 Usage

3. Journal 3.1 Overview

3.2 Usage

1. General Ledger Accounts

1.1 Overview

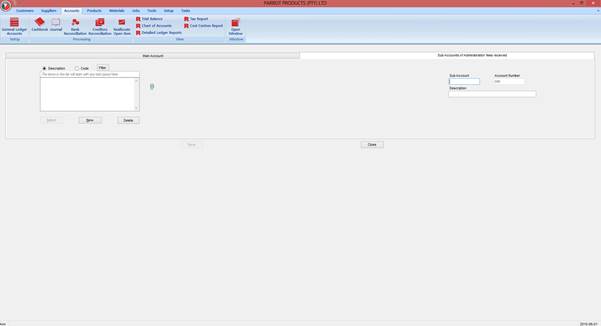

A company's main accounting records. A general ledger is a complete record of financial transactions over the life of a company. Displays all the General Ledger accounts used. Accounts can have subaccounts which is shown in the subaccounts tab after each account is selected.

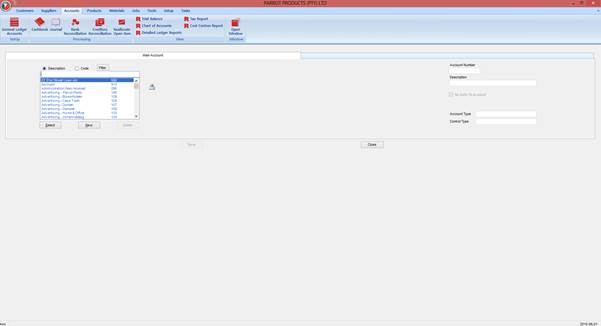

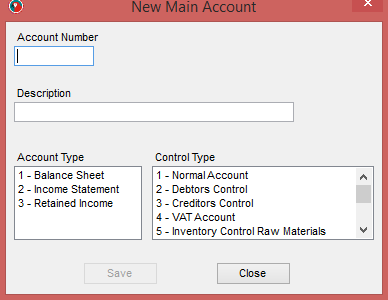

1.2 Create New Accounts

To create a new account. Click on the new button and enter details necessary in the below screen You need to choose the Account Type and the Control Type Account Types:

- Income Account - Any income or expense account should be created with account type as income account. For eg: Supplier accounts, Customer accounts, Finished goods, Raw Materials etc. You can choose appropriate Control type to further classify it. For customers you will choose Account Type Income Statement and Control Type as Debtors Control( as we have to receive money from them). For Suppliers you will choose Account Type Income Statement and Control Type as Creditors Control( as we need to pay them)

Balance sheet – Any expense that does not fall under income or expense but should be catered for in the balance sheet should have the account type as Balance Sheet Retained Income – Anything else that carries over from month to month and should still in part of balance sheet must have account type as retained. Currently profit falls in this category.

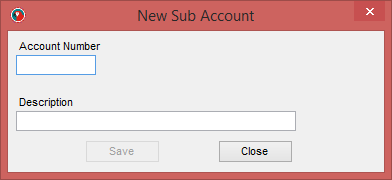

To create a new sub account for an account, click on the new button in the sub accounts screen. It will open up the following window. Give the necessary details and this sub account will be linked to the main account you choose.

You can delete accounts and sub accounts which do not have transactions.

1.3 Look Up Accounts

The General Ledger accounts are listed when you perform a account look up.

In Finished Goods or Raw Materials: When you click on the account fields link or textbox. The list of accounts displayed is defaulted to type General Ledger as those are income account items.

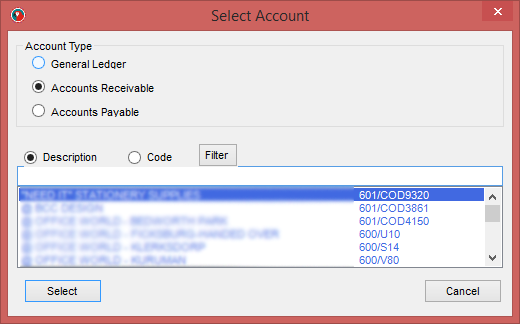

In Cashbook and Journal: Double Click on the account Code column. Here you can also choose accounts payable and accounts receivable.

2. Cashbook

2.1 Overview

A financial journal that contains all the cash receipts and payments, including bank deposits and withdrawals. Entries in the cash book are then posted into the general ledger. The cash book is periodically reconciled with the bank statements as an internal method of auditing. Cashbook can be defined as record keeping method for receipts and payments made.

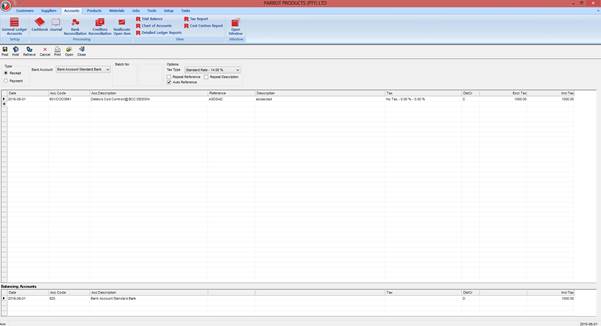

2.2 Usage

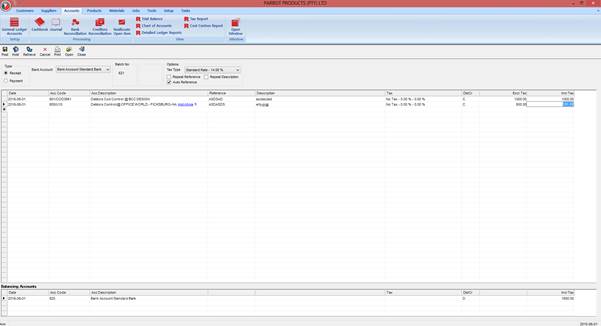

The accounts department take the bank statements once a day and see what payments have been made into the account and enter in cashbook

They enter details like

Date, reference, which customer, amount

It brings the invoices for the customer so they can relate the amount to invoices if needed.

As a credit is made, a debit entry is also made against corresponding contra account. This account is the bank recon account which needs to be

correspondingly credited or debited to reflect the recent status.

The entries made is called a batch and it can be held or posted. Posting will create journals and reconciled with the bank. If held the batch is saved against the persons login They can come in edit later and save it.

On the screen you can choose if the entries being captured are Receipts or payments.

IF receipts are chosen the entries in the Cashbook grid(top one) will have ‘C’ as default type and the entry in Summary grid( bottom one) will have ‘D’ as type The reason for this is the user is capturing the credits made in the Cashbook and same amounts must be then debited from the bank recon account in the summary grid.

If tax is present, the summary grid will have another entry for tax amounts which will be debited from the tax account.

The user can double click on the Acc Code column to select the customer or supplier for which they are capturing entries.

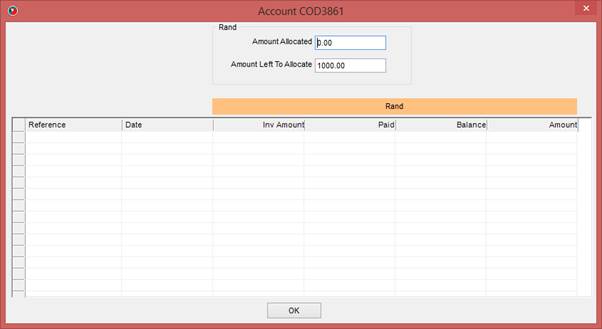

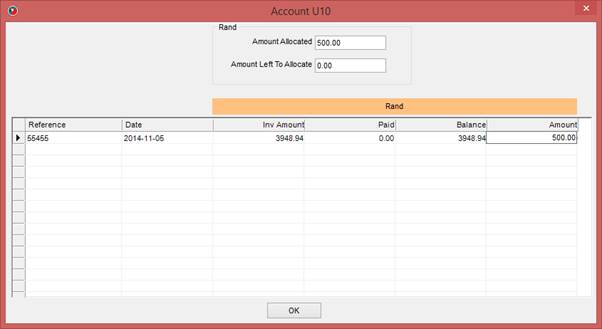

Once the entry is filled it need to be allocated. This means that the entry can be linked to particular invoice if there is any or even left as is.

This is done in the add allocations screen. The screen is invoked by either clicking on the Add Alloc link on the line entered or by right clicking the row and selecting Add Allocations.

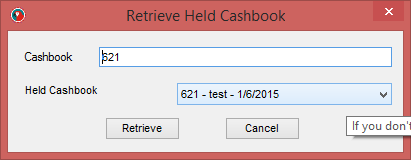

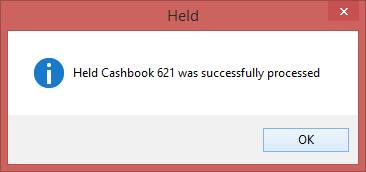

If the user chooses to work on the cashbook later and wants to save it they can click on the hold menu button and hold the cashbook for later use.

On clicking the hold button the user will need to fill out a name for the held cashbook so they can retrieve later.

To retrieve held cashbook, user must click retrieve button and select the cashbook from the list. When retrieve is pressed, the held cashbook is loaded.

The user can then edit or modify the cashbook and post it.

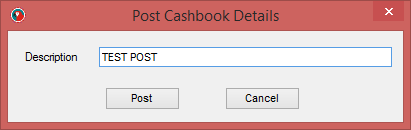

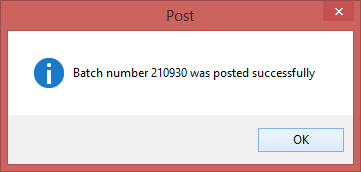

To post a cashbook, click on the post button. The below message gives the cashbook number.

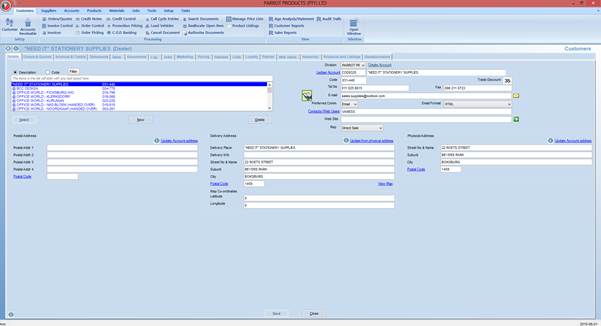

Once posted you can review the effects on the statements of the customers and suppliers by choosing them and viewing their statements.

3. Journal

3.1 Overview

Journals are used to make corrections.

Is a way of moving money from one account to another.

It is moved from what is entered in the acc code column to the one in the contra acc column

Entry type

- General Ledger

- Purchase Journal

Type

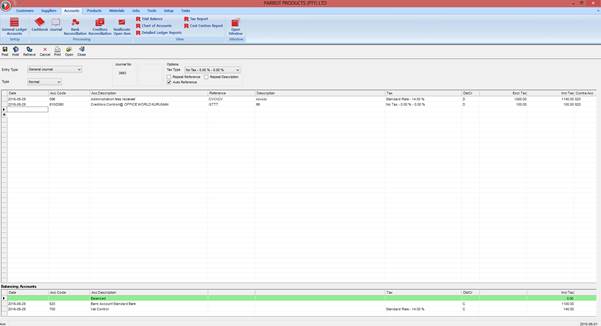

3.2 Usage

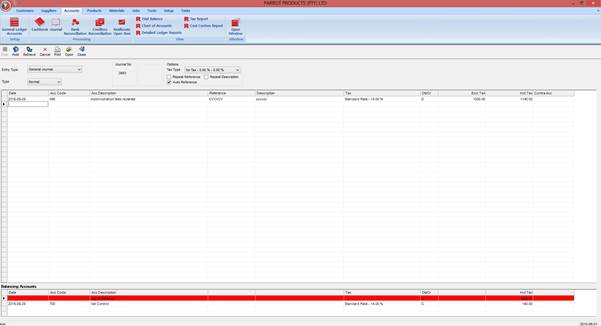

The accounts dept generally only use the General Journal

When you enter a record without the contra acc the balancing account is highlighted to inform that these is an out of balance.

As soon as you put the contra account it knows which account needs to be credited and everything is in balance.

If tax is present it goes into a different account.

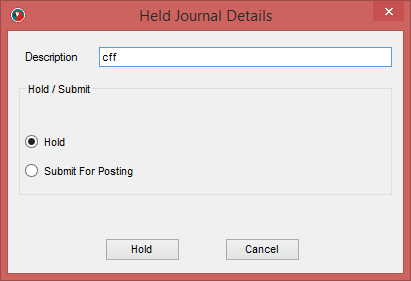

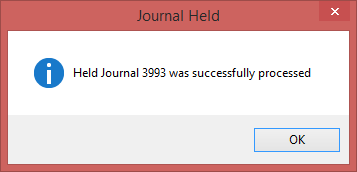

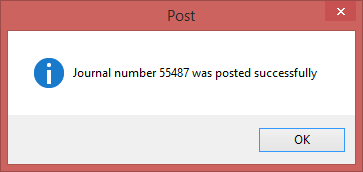

You can hold journal, post journal.

When you post depending on the type of account you chose statements or ledgers are created.

For Example:

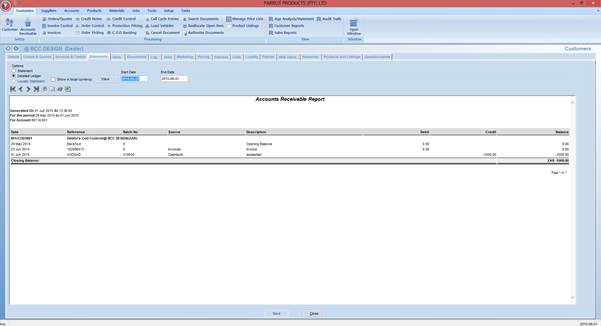

If you chose a customer account the general ledger for that customer is updated. You can view this on the customer detailed ledger.

If account receivable is chosen a statement is created for the customer.

If accounts payable is chosen a statement is created for the supplier

If there are statements that are repeated every month it is saved as a recurring journal so each month user does not have to enter. They can just update the date and amount and post.